/ Sendero Concept

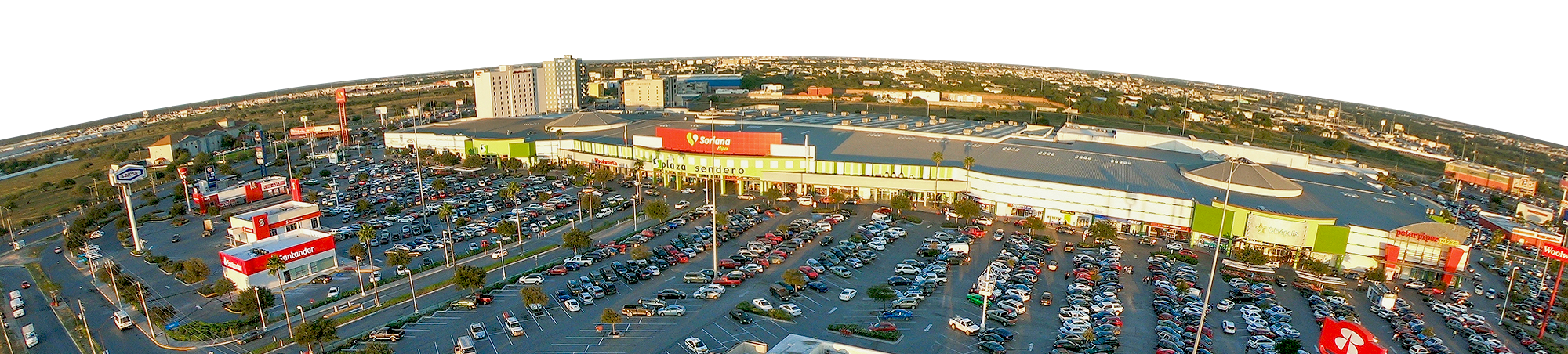

With more than 30 years of experience in the development, operation and management of community shopping centers, in 2002, Acosta Verde created the Plaza Sendero shopping centers brand, with Plaza Sendero Escobedo, located in the state of Nuevo Leon, being the first shopping center under this concept.The Sendero shopping centers are characterized by offering a meeting point where people can shop while having access to a variety of entertainment activities, using self-service stores and cinemas as anchors.

This has contributed to the fact that the shopping centers under this concept stood out for their high occupancy levels and visitor traffic volume, even during complex times, such as the financial crisis of 2008-2009 and the COVID-19 pandemic.

Due to all this, Acosta Verde has managed to position the Plaza Sendero model as one of the most attractive options for the growth of Mexico's main retailers, which has allowed it to consolidate long-term relationships with the most renowned brands in the country.

Layout

The following is the distribution of spaces for the Plaza Sendero model, as well as some of the brands that have chosen us within some or all of the plazas in the portfolio:

Prime Location

Retail Focus

Shopping Experience

Tenant Composition

Physical Features

- 1 supermarket

- 1 cinema

- Between 4 and 5 department stores

- Between 2 and 3 bank branches

- From 2 to 4 stores (department stores, banks, or restaurants) in stand-alone format in the parking area

- Between 4 and 6 restaurants plus a food court

- ~100 stores for entertainment, clothing, footwear, electronics, gyms, among others

Operating Strategy

- Tenants with brands dedicated to children's and family entertainment as a core part of the composition of the shopping center's offer.

- Social events for all members of the family, concerts with trendy and famous artists.

- Increased opening of gyms

- Plaza Sendero is a community gathering point for the communities in which it operates.

Proven Results

/ Properties

As of December 31, 2022, Acosta Verde's portfolio consists of 18 properties, 17 in operation and 1 in development, remaining unchanged from 2021.

The Portfolio under Development includes Sendero Ensenada, whose construction was interrupted due to the effects of COVID-19. Its conclusion will be defined once the macroeconomic context allows us to guarantee compliance with the standards characteristic of the Plaza Sendero concept.

At the same time, Acosta Verde remains well positioned to take advantage of investment opportunities that allow it to increase value generation. Therefore, the Company constantly analyses various investment opportunities in order to capitalize on those that are aligned with its profitability standards.

At the end of 2022, the portfolio consists of the following properties:

(1) Percentage of total revenue and NOI generated by the GLA owned by Acosta Verde and consolidated in the Company's financial statements.

(2) Acosta Verde's co-ownership share of each shopping center.

It is worth mentioning that, in order to be aligned with market practices, as of 2022, the indicators began to be reported in a single category as Total Portfolio (no longer classified as Stabilized and In Stabilization). However, in terms of consistency, the Same Shopping Centerswill be used when required.

/ Geographic Footprint

Acosta Verde's shopping centers are located in cities nearby and/or within manufacturing or service zones, these provide a high growth potential in terms of customers and visitor traffic.

At the end of 2022, the 18 properties of the Company's Total Portfolio are distributed in nine Mexican states, mainly in the northeast and northwest region.

* Under development as of December 31, 2022.

/ Main Tenants

During 2022, the Plaza Sendero brand maintained a high level of relationship with its tenants, always prioritizing communication with them to understand and satisfy their needs, in order to encourage long-term relationships. Thanks to this:

Acosta Verde has achieved that up to 50% of the GLA of each new Plaza Sendero is leased to national chains, which helps to achieve the goal of a high GLA occupancy rate since opening.

The Plazas Sendero have registered high levels of commercialization and visitor traffic since the first day of operation, as well as a diversified offer for visitors.

For this reason, year after year, a large part of the Company's efforts are focused on strengthening the national force sales to maintain the closeness and constant communication with tenants that characterizes the Plaza Sendero brand.

In addition, Acosta Verde always seeks to incorporate new tenants before and after the opening of the shopping centers, which, once they are established, we provide a follow-up in a timely manner to anticipate service requests and therefore ensure their maximum comfort, in order to guarantee the future renewal of the leases.

As a result of this teamwork, the Plaza Sendero model has managed to make a significant number of business partners become recurring, meaning they have a presence in 7 or more shopping centers owned by Acosta Verde, and that more local, regional or national chains are considering Plazas Sendero as their first choice for growth.

Among the leading brands we collaborate with are Cinépolis, Mexico's leading cinema operator; Liverpool, a leading national department store chain, whose Suburbia concept has been successfully integrated into many of Acosta Verde developments; and Soriana, one of the country's largest supermarket chains.

In addition to these anchor stores, we have managed to attract other recognized brands such as Casa Ley (leader in supermarkets in the northwest region of Mexico), Merco, Smart, C&A, Happyland, Circus Park, SmartFit, Promoda, Miniso, Carl's Jr., Starbucks, Coppel, Del Sol, Woolworth, Ultra Gym, Cuidado con el Perro, Parisina, among others.

Finally, the Company has a team dedicated to the renewal and retention of customers, whose task is to be aware of the lease expiration calendar, in order to carry out the corresponding negotiations to ensure the highest possible percentage of renewals and increase the lease spread (indicator that reflects the variation between the average rent of a group of renewed leases vs. the previous average rent of such leases).

CHARACTERISTICS OF THE LEASE CONTRACTS

One of the most important aspects for Acosta Verde is to have a diverse offer through diversified leases in terms of business and geographic location, as this improves the visitors' experience by ensuring that during their visit they can satisfy all their consumption, leisure and service needs.

In this regard, at the end of 2022, there are approximately 1,744 lease contracts as part of the Total Portfolio. Likewise, as part of the operating income is generated through the leasing spaces in common areas, the corresponding contracts for these areas totaled 373 at the end of 2022.

IN TERMS OF GLA, ACOSTA VERDE'S TOP 10 TENANTS ARE:

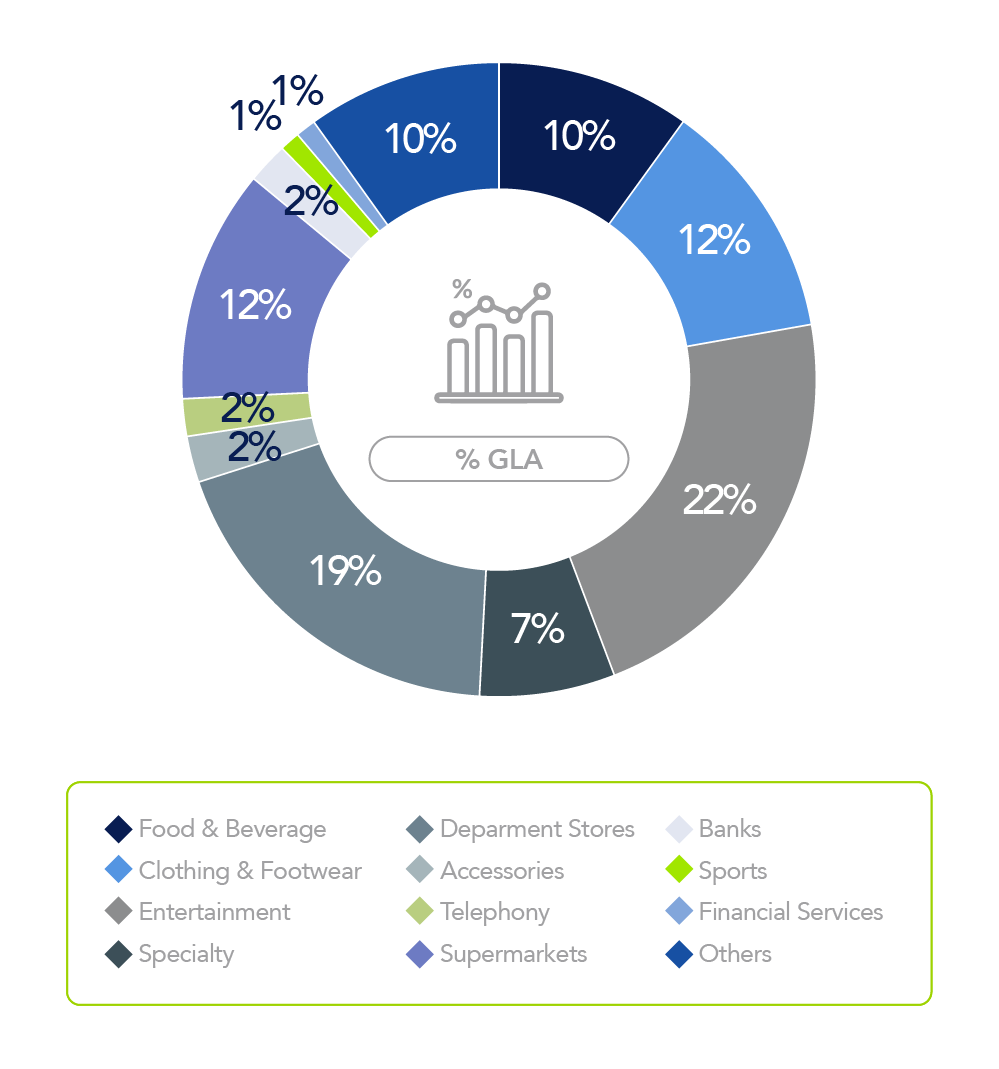

LEASE CONTRACTS BREAKDOWN BY SECTOR

AS A PERCENTAGE OF GLA:

LEASE CONTRACTS BREAKDOWN BY SECTOR

AS A PERCENTAGE OF FIXED RENT:

/ Key Operating Metrics

At the end of 2022, the portfolio was comprised of 17 shopping centers developed and operated under the Community Center modality that distinguishes the Sendero brand, with a total GLA of 442,044 m2.

Likewise, the portfolio includes eight sub-anchors whose premises are located within five Acosta Verde shopping centers. These sub-anchors were acquired in 2017 through the CIB 2715 Trust and their income is recognized by equity method, Acosta Verde's participation is 50%.

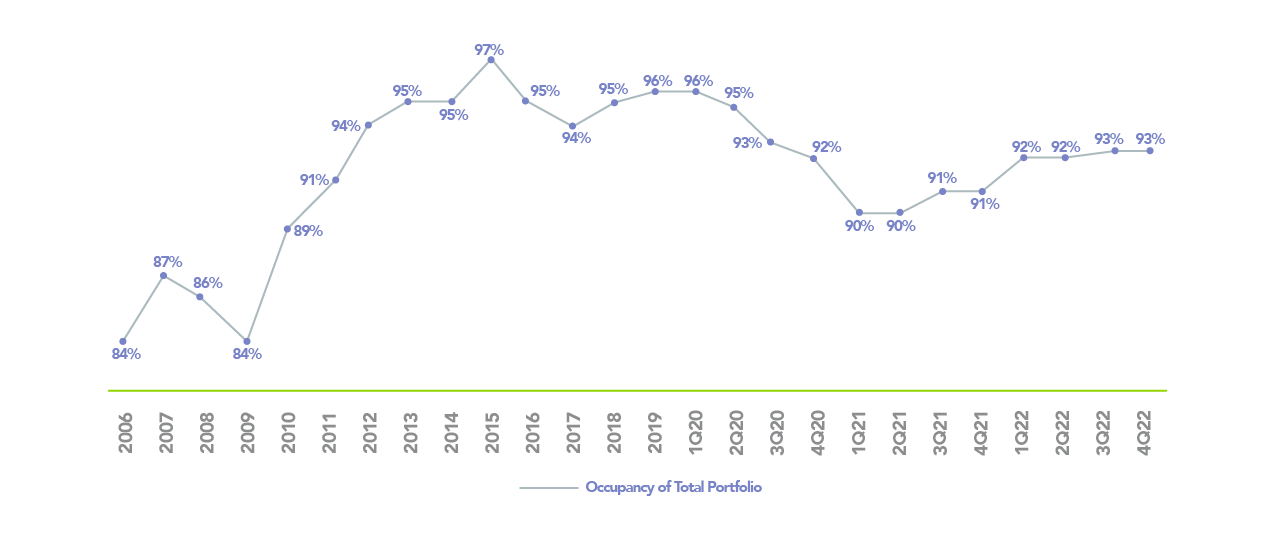

Occupancy of the Operating Portfolio

The occupancy of the operating portfolio stood at 92.9% at the end of 2022, representing an increase of 2.2 pp. with respect to the 90.7% recorded in 2021, as a result of the efforts deployed to encourage greater affluence in Plazas Sendero for the benefit of our tenants, as well as the extraordinary work of our sales force to attract new tenants, and of our customer renewal and retention team to maintain the long-term relationships that characterize the Sendero brand.

% OCCUPANCY OF TOTAL PORTFOLIO:

OCCUPANCY BREAKDOWN BY PROPERTY:

(1) Refers to 8 sub-anchor stores located in different Sendero shopping centers in Chihuahua, State of Mexico, Tamaulipas and San Luis Potosí.

/ Visitor and Vehicle Traffic

Thanks to the easing of restrictions and Grupo Acosta Verde's commercial efforts, the shopping centers operated during their regular hours, thus encouraging the traffic of visitors and vehicular traffic.

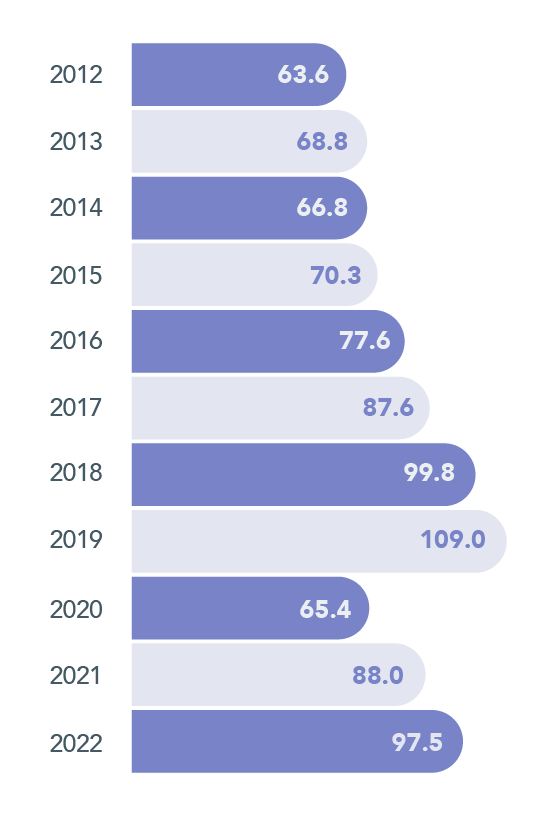

In this sense, during 2022, the increase in the affluence of visitors to the shopping centers was 11%, from 88 million visitors in 2021 to 97 million in 2022.

Vehicle traffic was 22.7 million in 2022, up 15% from the 19.7 million vehicles recorded in 2021. It is worth noting that vehicle traffic recorded in all quarters of 2022 was higher than that recorded before the pandemic.

TRAFFIC (MILLIONS OF VISITORS)

QUARTERLY VEHICULAR TRAFFIC IN PARKING LOTS (MILLIONS OF VEHICLES)

/ Maturity of Lease Agreements

As of December 31, 2022, contract maturities, in terms of GLA and fixed rent, are as follows:

(*)Contracts that as of December 31, 2022 are in the process of renewal.

It is worth noting that most of the GLA and fixed rents have maturities up to 2027 and beyond.

Lease Renewal and Lease Spread

Throughout 2022, Acosta Verde successfully renewed a total of 442 leases, equivalent to 51,487 m2 of GLA of the operating portfolio.

The Lease Spread for the year (an indicator that reflects the variation between the average rent of a group of new leases compared to the average rent that expired in relation to this same group) was 8.9%, based on the 57,427 m2 renewed and replaced during 2022.

/ Economic Contribution (1)

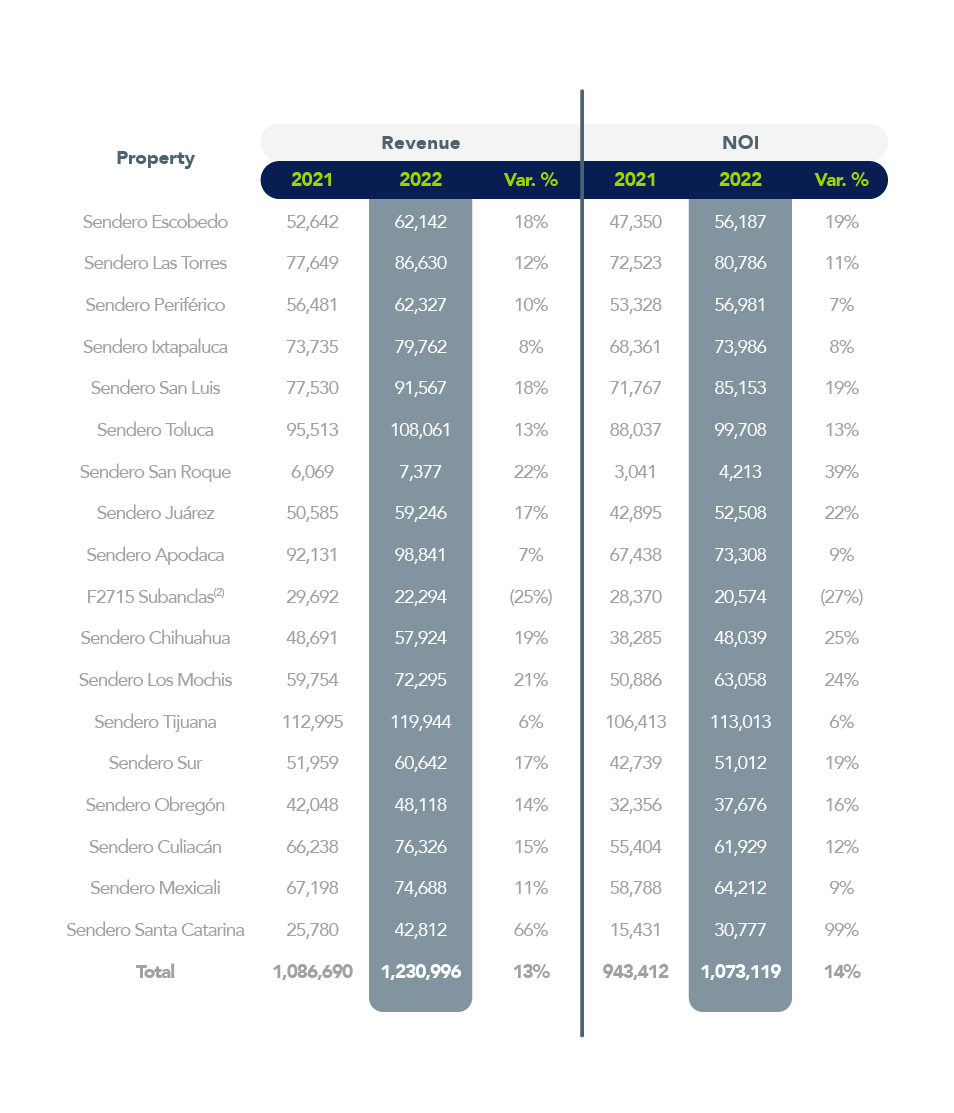

In terms of the portfolio's economic contribution, Acosta Verde's commercial efforts allowed it to grow throughout the Operating Portfolio in its year-over-year comparison.

In this regard, the financial results of the 2022 portfolio, on a cash flow basis, were as follows:

Revenues and NOI

The portfolio's revenue is comprised of Fixed Rent, Variable Rent (% of sales), Common Areas (parking, advertising, common space rental) and Key Money.

REVENUE AND NOI PER PROPERTY

(THOUSANDS OF MEXICAN PESOS)

(1) The information disclosed in the Economic Contribution subsection considers the following:

The information shown is on a cash flow basis and not on an accrual basis.

The information of the following shopping centers includes minority interests where Acosta Verde has a stake: Chihuahua 56.9%, Los Mochis 56.9%,

Tijuana 75.6%, Sur 75.6%, Obregón 75.6%, Culiacán 75.3% and Mexicali 100% and Santa Catarina 40%.

(2) Includes 100% of the revenue and or NOI from the CIB 2715 Trust, which are not consolidated in Acosta Verde and are recorded by the equity method (Acosta Verde's stake is 50%).

REVENUE BREAKDOWN (CONSOLIDATED)

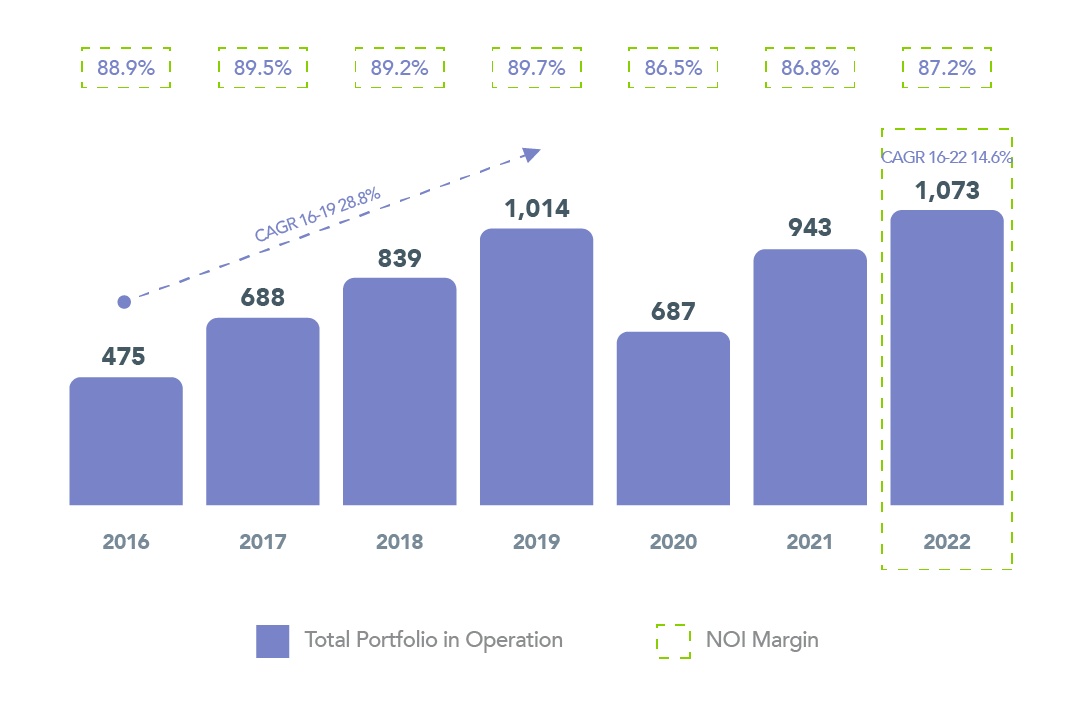

The following graph shows NOI behavior over the past 7 years, as well as NOI margin on revenues: